Condo Insurance in and around Monroe

Unlock great condo insurance in Monroe

Condo insurance that helps you check all the boxes

Welcome Home, Condo Owners

Being a condo owner isn't always easy. You want to make sure your condo and personal property in it are protected in the event of some unexpected mishap or catastrophe. And you also want to be sure you have liability coverage in case someone becomes injured on your property.

Unlock great condo insurance in Monroe

Condo insurance that helps you check all the boxes

Safeguard Your Greatest Asset

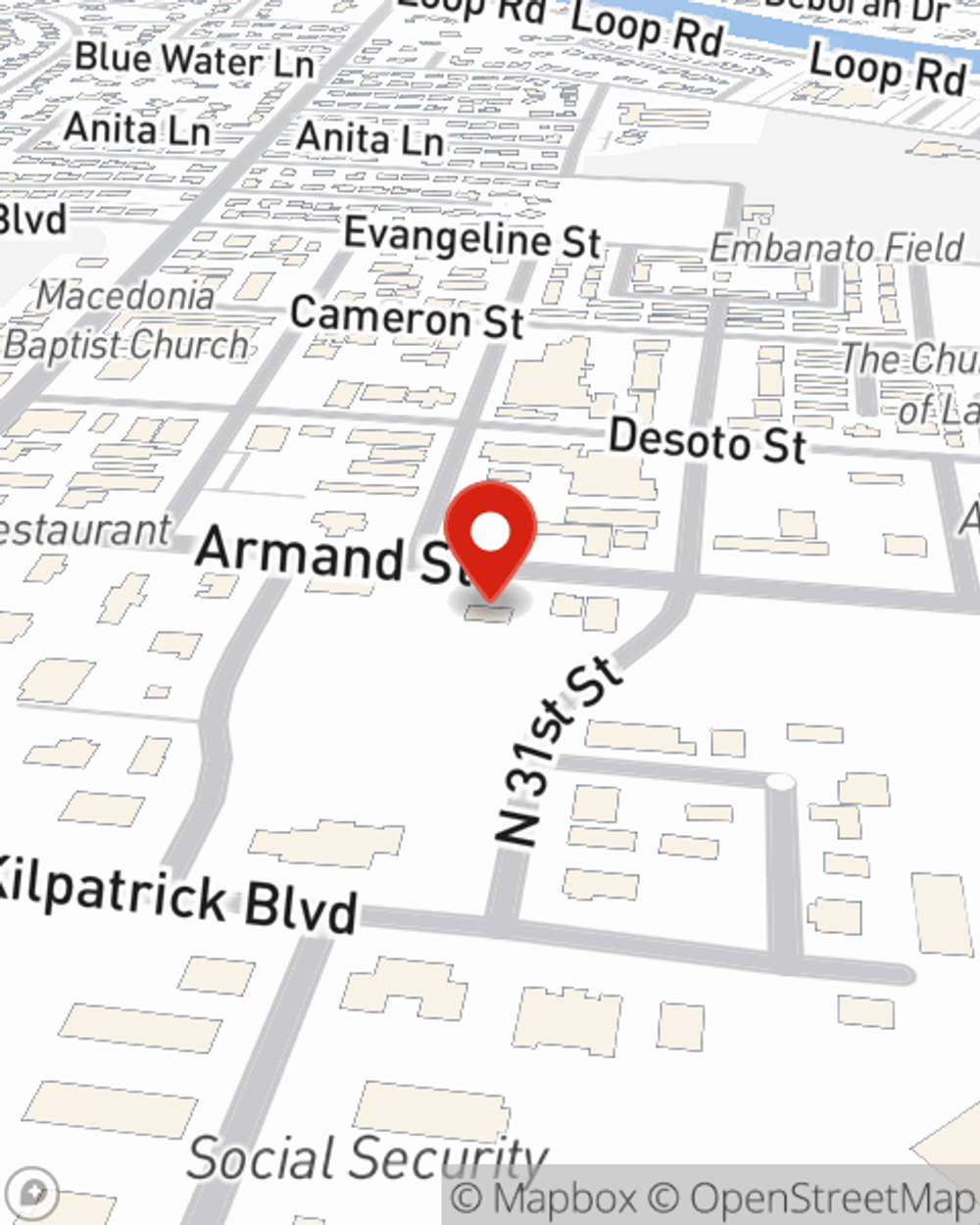

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Greg Manley, Jr. is ready to help you navigate life’s troubles with dependable coverage for all your condo insurance needs. Such individual service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Greg Manley, Jr. can help you submit your claim. Keep your condo sweet condo with State Farm!

Dependable coverage like this is why Monroe condo unitowners choose State Farm insurance. State Farm Agent Greg Manley, Jr. can help offer options for the level of coverage you have in mind. If troubles like drain backups, wind and hail damage or identity theft find you, Agent Greg Manley, Jr. can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Greg at (318) 323-0521 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Greg Manley, Jr.

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.